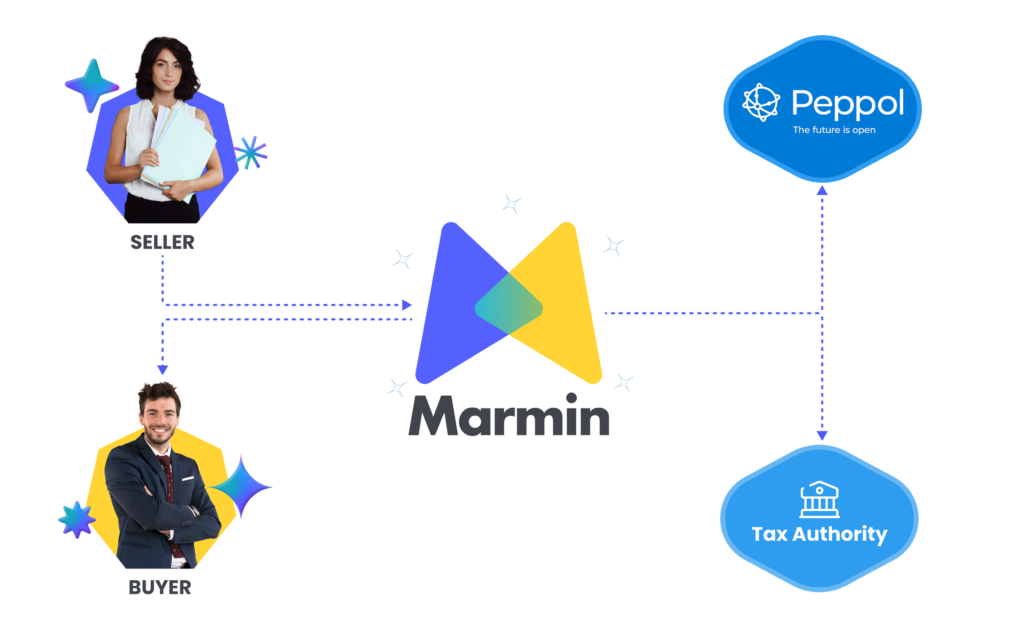

A Global E-Invoicing Platform

Easy E-Invoicing For Businesses

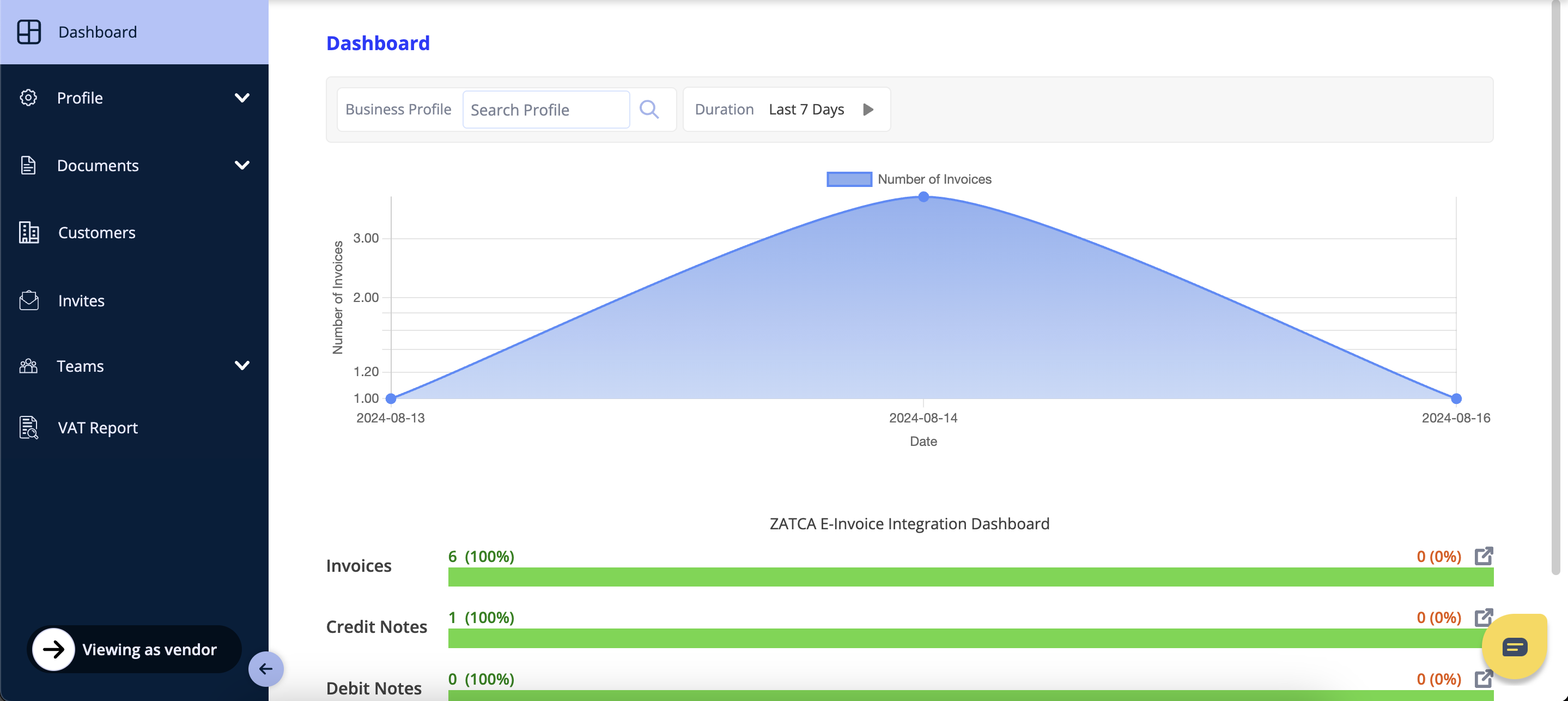

Cloud compliance platform for business with high reliable integration high availability and scalability with enterprise grade security and error free reporting.

★ ★ ★ ★ ★ Trusted By 600+ Businesses

Approved E-Invoicing Solution Provider

Effortless

Simplify your eInvoicing Journey. Smooth, Minimal Effort & Stress Free Enablement

Scalable

One invoice or 100,000 invoices. Not a worry. Create invoices at scale. Generate up-to 6000 Invoices Per Minute

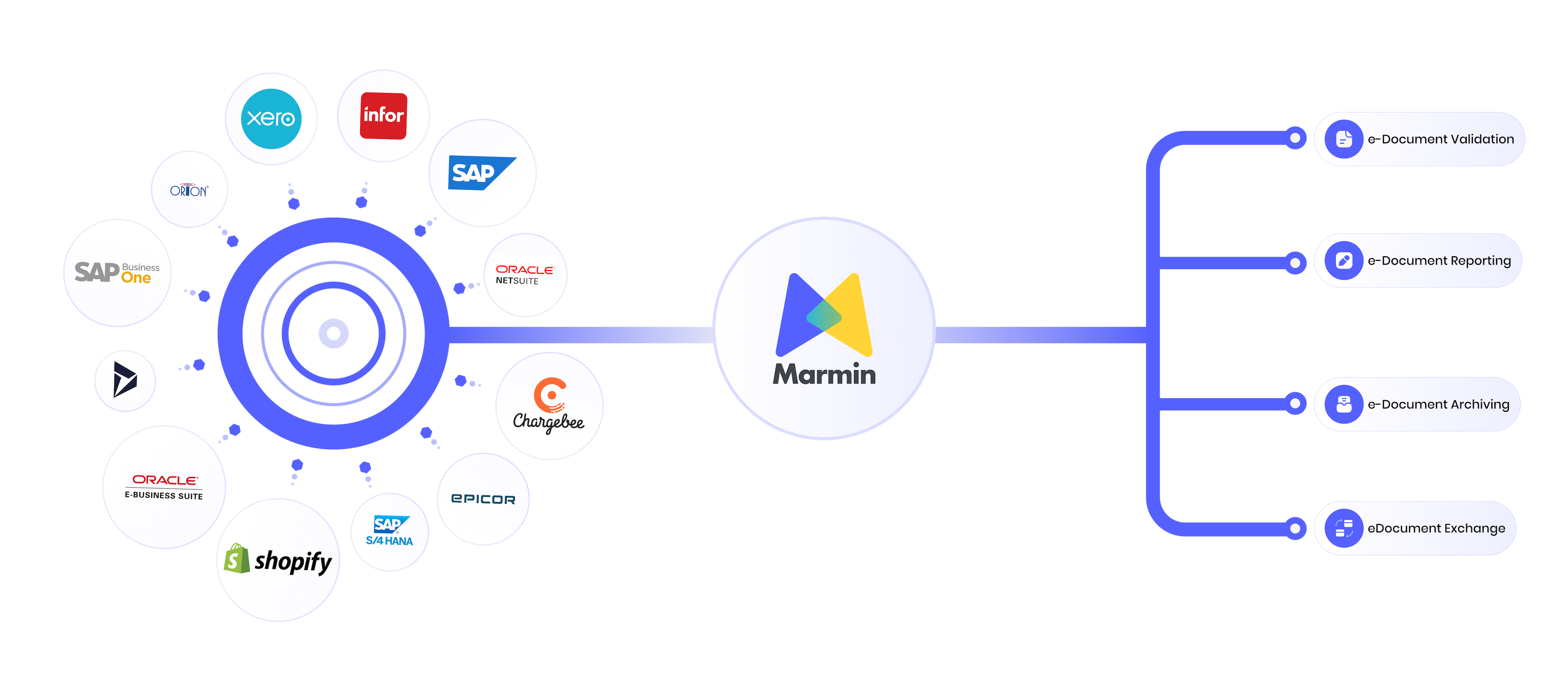

ERP Agnostic

Global ERPs or Custom In-House Solutions. Our integration capabilities have you covered.

Secure

Data Encryption in Transit, Data Encryption at Rest, and Data Localisation

Compliant

Global e-invoicing compliance covered in a single platform

Efficient

API integration response under 500ms with 99.9% e-Invoice approval rate

Integrate With Your Favorite ERP/Accounting Tool

Developer Friendly Platform

Our eInvoicing API’s performance is unmatched

- Self-Serve Integration

- Product Wiki

- Auto Scaling Ready

- Exhaustive API Documentation

Reliable Responsive APIs

180+ API Validations For An Error Free eInvoice

Integration Support

Full support for Self-Serve Integration

Uptime Guaranteed

e-Invoicing Delivered (‘Offline’ or ‘Online’ )

Your Focus – Growing Your Business, Our Focus – Your e-Invoice Compliance

Our ERP agnostic e-Invoicing platform enables

- Quick Implementation

- Faster Adoption

- Easy Change Management

- Eliminates Non-Compliance Risk

All the tools you need

Developer Friendly

Easy to use

Made for everyone

Explore Our Features

Bulk Upload Feature

E-invoicing Compliance In Minutes. Use our exclusive upload feature and generate e-invoices in bulk

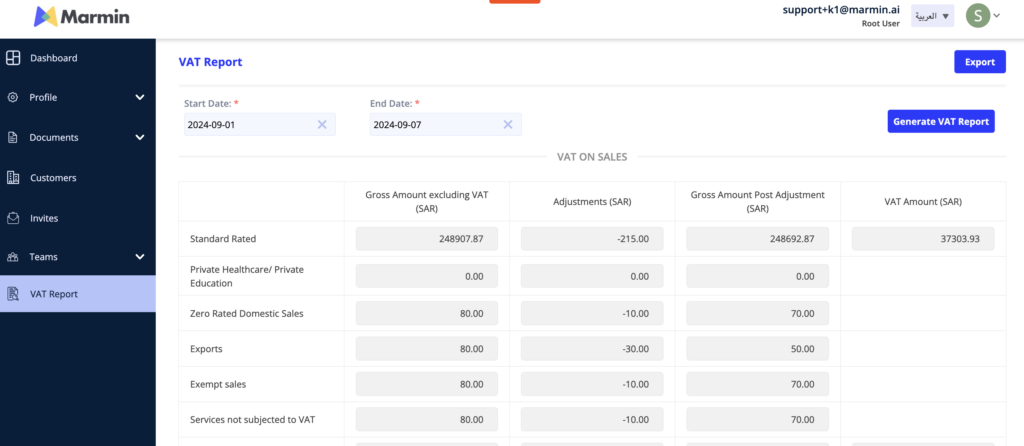

Automatic VAT/Tax Calculations

Source ERP invoices automatically reconcile with reported e-invoices, ensuring that VAT/Tax liability reports reflect only successfully reported invoices.

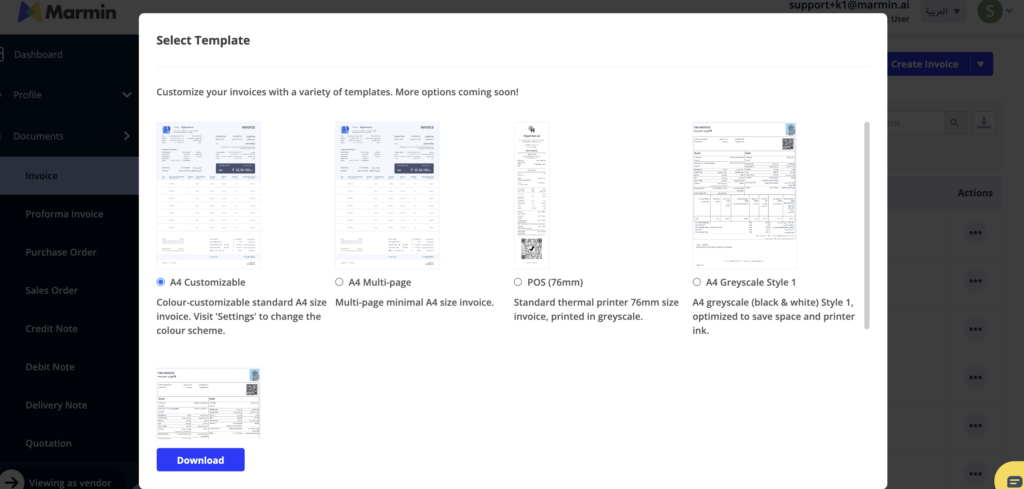

Invoice Template Customisation

Select from a range of invoice PDF A/3 templates, custom-designed to meet specific regional requirements. Secure and Tamper Proof

We Deliver Exceptional Value to Global Business

Marmin has built long-term relationships with top-tier global and home-grown customers who entrust us to help them continually achieve regulatory compliance, operational functionality for their users, and stay ahead of the technology curve

Why our Clients Love Us

Don’t just take our word for it, hear what our awesome customers have to say about us

★★★★★

“TBH has been incredibly impressed with Marmin.AI for all our e-invoicing needs. Their platform is intuitive and straightforward to implement, making the integration process seamless and efficient. We are confident that Marmin.AI is the ideal partner for our global e-invoicing requirements and will continue to rely on their expertise moving forward.”

Francois Vandenheever

Group Head of IT, TBH Consultancy (KSA)

★★★★★

“Marmin has streamlined our invoicing process, allowing us to focus on our core business while they handle the E-Invoicing compliance through seamless API integration.”

Mohammad Johary

ERP Product Lead, Syarah.com (KSA)

★★★★★

“Since we have started collaboration with marmin.ai (almost 2 years ago) we noticed the professional way of treating our requirements. For any single request they were asking for In-Person meeting, giving us the possibility to explain better our issue, and always they were trying to solve it the soonest possible. I can say, I am very happy with this partnership and for sure Marmin ZATCA Solution is Value for Money choice.”

Theodoros Tsironis

SIGMA Group Head of IT (KSA) (sigmaksa.com)

★★★★★

“We at SAMI Advanced Electronics Support Services Company are connected with Marmin since E-invoicing is introduced by ZATCA and already integrated for Phase 2. We can say that the product features and service we received from MARMIN is exceptional. The team is professional and qualified, above all they are always there to guide. We would like to extend our thanks to the leadership team for continuous efforts and support. We wish MARMIN more success and growth.”

Husnain Ali Ghafoor

Invoice and Billing Specialist (AESSCo- SAMI KSA)

★★★★★

“We’ve been really impressed with Marmin’s seamless integration with Xero. It has simplified our accounting tasks and ensures everything syncs effortlessly. Their customer service is top-notch—quick responses and efficient support every time we reach out. Marmin has truly made our financial processes much smoother. Thank you for your excellent service!”

Pranav Gohil

JAM Event Services (KSA)(jameventservices.com)

★★★★★

“TBH has been incredibly impressed with Marmin.AI for all our e-invoicing needs. Their platform is intuitive and straightforward to implement, making the integration process seamless and efficient. We are confident that Marmin.AI is the ideal partner for our global e-invoicing requirements and will continue to rely on their expertise moving forward.”

Francois Vandenheever

Group Head of IT, TBH Consultancy (KSA)

★★★★★

“Marmin has streamlined our invoicing process, allowing us to focus on our core business while they handle the E-Invoicing compliance through seamless API integration.”

Mohammad Johary

ERP Product Lead, Syarah.com (KSA)

★★★★★

“Since we have started collaboration with marmin.ai (almost 2 years ago) we noticed the professional way of treating our requirements. For any single request they were asking for In-Person meeting, giving us the possibility to explain better our issue, and always they were trying to solve it the soonest possible. I can say, I am very happy with this partnership and for sure Marmin ZATCA Solution is Value for Money choice.”

Theodoros Tsironis

SIGMA Group Head of IT (KSA) (sigmaksa.com)

★★★★★

“We at SAMI Advanced Electronics Support Services Company are connected with Marmin since E-invoicing is introduced by ZATCA and already integrated for Phase 2. We can say that the product features and service we received from MARMIN is exceptional. The team is professional and qualified, above all they are always there to guide. We would like to extend our thanks to the leadership team for continuous efforts and support. We wish MARMIN more success and growth.”

Husnain Ali Ghafoor

Invoice and Billing Specialist (AESSCo- SAMI KSA)

★★★★★

“We’ve been really impressed with Marmin’s seamless integration with Xero. It has simplified our accounting tasks and ensures everything syncs effortlessly. Their customer service is top-notch—quick responses and efficient support every time we reach out. Marmin has truly made our financial processes much smoother. Thank you for your excellent service!”

Pranav Gohil

JAM Event Services (KSA)(jameventservices.com)

★★★★★

“TBH has been incredibly impressed with Marmin.AI for all our e-invoicing needs. Their platform is intuitive and straightforward to implement, making the integration process seamless and efficient. We are confident that Marmin.AI is the ideal partner for our global e-invoicing requirements and will continue to rely on their expertise moving forward.”

Francois Vandenheever

Group Head of IT, TBH Consultancy (KSA)

★★★★★

“Marmin has streamlined our invoicing process, allowing us to focus on our core business while they handle the E-Invoicing compliance through seamless API integration.”

Mohammad Johary

ERP Product Lead, Syarah.com (KSA)

★★★★★

“Since we have started collaboration with marmin.ai (almost 2 years ago) we noticed the professional way of treating our requirements. For any single request they were asking for In-Person meeting, giving us the possibility to explain better our issue, and always they were trying to solve it the soonest possible. I can say, I am very happy with this partnership and for sure Marmin ZATCA Solution is Value for Money choice.”

Theodoros Tsironis

SIGMA Group Head of IT (KSA) (sigmaksa.com)

★★★★★

“We at SAMI Advanced Electronics Support Services Company are connected with Marmin since E-invoicing is introduced by ZATCA and already integrated for Phase 2. We can say that the product features and service we received from MARMIN is exceptional. The team is professional and qualified, above all they are always there to guide. We would like to extend our thanks to the leadership team for continuous efforts and support. We wish MARMIN more success and growth.”

Husnain Ali Ghafoor

Invoice and Billing Specialist (AESSCo- SAMI KSA)

★★★★★

“We’ve been really impressed with Marmin’s seamless integration with Xero. It has simplified our accounting tasks and ensures everything syncs effortlessly. Their customer service is top-notch—quick responses and efficient support every time we reach out. Marmin has truly made our financial processes much smoother. Thank you for your excellent service!”

Pranav Gohil

JAM Event Services (KSA)(jameventservices.com)